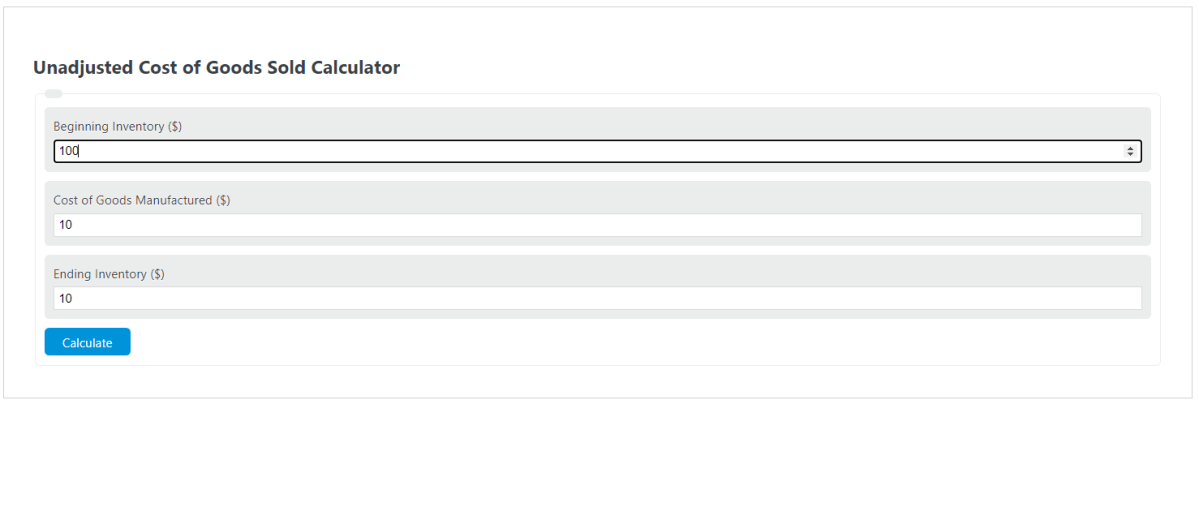

1. Unadjusted Cost of Goods Sold Calculator

Jul 27, 2023 · To calculate unadjusted cost of goods sold, sum the beginning ... cost of goods manufactured, then subtract the ending inventory value.

Unadjusted Cost of Goods Sold Calculator Basic Calculator Advanced Calculator Enter any 3 values to calculate the missing variable Beginning Inventory ($)

2. Gross Profit: What It Is & How to Calculate It - Investopedia

Missing: unadjusted | Show results with:unadjusted

Gross profit is the profit a company makes after deducting the costs of making and selling its products or the costs of its services.

:max_bytes(150000):strip_icc()/grossprofit-e747767ca30540af8f61064da45ee6a9.jpg)

3. Cost of Goods Manufactured (COGM)

The raw materials used in production (d) is then transferred to the WIP Inventory account to calculate COGM. To learn more, launch our free accounting courses!

Cost of Goods Manufactured (COGM) is a term used in managerial accounting that refers to a schedule or statement that shows the total

4. Cost of Goods Sold (COGS) Explained With Methods to Calculate It

Missing: unadjusted | Show results with:unadjusted

Cost of goods sold (COGS) is defined as the direct costs attributable to the production of the goods sold by a company.

:max_bytes(150000):strip_icc()/Cost-of-Goods-Sold-COGS-60d335925dd14754a278392cae907b92.png)

5. Cost of Goods Available minus Cost of Goods - StudyX

Jun 22, 2024 · Cost of Goods Sold is the total cost of goods that have been sold during the period. Step 3: Calculate the Difference Subtracting COGS from COGA ...

[Solved] Cost of Goods Available minus Cost of Goods Sold equals Group of answer choicesCost of Goods ManufacturedFinished Goods Ending InventoryRaw

6. 8.3 The Calculation of Cost of Goods Sold – Financial Accounting

The expense is found by adding the beginning inventory to the purchase costs for the period and then subtracting ending inventory. A year-end adjusting entry ...

At the end of this section, students should be able to meet the following objectives:

7. Taxation: Unraveling the Unadjusted Basis in Tax Reporting - FasterCapital

Jun 14, 2024 · The gain or loss on the sale or exchange of an asset is calculated by subtracting the unadjusted basis from the sale or exchange price. For ...

Unadjusted basis in tax reporting is a crucial component in calculating taxes, especially in the case of property sales or exchange. The unadjusted basis is the initial value of an asset, which includes the purchase price, closing costs, and any other expenses incurred to acquire the asset. The...

8. Applied Overhead Versus Actual Overhead - Accounting In Focus

These accountants are adding direct materials, direct labor and applied overhead to jobs to calculate the cost of goods sold on every job that is sold. The ...

See AlsoSterling Primary Care FranklinIn the previous post, we discussed using the predetermined overhead rate to apply overhead to jobs. This applied overhead is an approximation. What about actual spending for overhead costs? Let’s review how we got applied overhead. First, we calculated the predetermined overhead rate by dividing estimated overhead by estimated activity. Then we multiplied the predetermined overhead …

9. Bus1A Cheat sheet (docx) - CliffsNotes

Jan 30, 2024 · When the merchandise is sold, its cost is transferred from the balance sheet to the income statement, where it is reported as cost of goods sold ...

As you were browsing something about your browser made us think you were a bot. There are a few reasons this might happen:

10. Cost of Goods Sold (COGS) | Formula + Calculator - Wall Street Prep

Mar 24, 2024 · The calculation of COGS is distinct in that each expense is not just added together, but rather, the beginning balance is adjusted for the cost ...

Cost of Goods Sold (COGS) refers to the direct costs incurred by a company while selling its goods/services to generate revenue.

11. Texas service sector activity rebounds - Dallasfed.org

Dec 27, 2023 · Input and selling price pressures picked up slightly while wage growth remained unchanged in December. The input prices index increased three ...

Growth in Texas service sector activity resumed in December, according to business executives responding to the Texas Service Sector Outlook Survey.

12. Manufactures - Census.gov

Unadjusted through 1950; thereafter, adjusted. For definitions, see ... the sales value and cost of merchandise sold without further manufacture ...

13. [PDF] Pelagic Fisheries of the Western Pacific Region

... unadjusted and inflation-adjusted dollars 1986-2013 including consumer price index (CPI) ........... 86. Table 37. American Samoa average price per pound of ...

14. Brian Browne - Westside Observer

It is calculated by subtracting accumulated depreciation from historical ... calculated on the weighted average cost of capital (internal and outside funding).

Brian Browne was coauthor of 2002 Prop P and former member of the Revenue Bond Oversight Committee it created.

15. Accounting Basics | OER Commons

... calculation of income or loss. In the multiple step approach, “gross profit” is sales minus cost of goods sold. Subsequently, subtracting operating expenses ...

The Balance Sheet

16. Exam 1 Flashcards by sonyawen28 - Brainscape

Gross profit is determined by subtracting the cost of merchandise sold from what? ... Sales returns, accounts receivable, merchandise inventory, and cost of goods ...

Study Exam 1 flashcards from sonyawen28 .'s ualr class online, or in Brainscape's iPhone or Android app. ✓ Learn faster with spaced repetition.